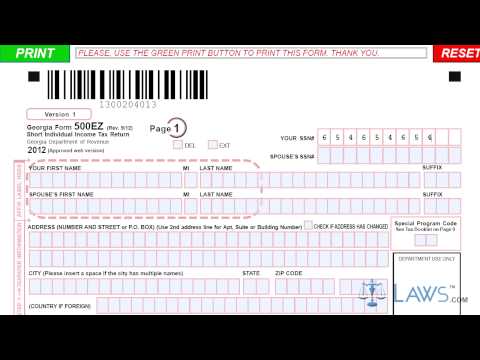

Laws.com provides a legal forms guide for Georgia residents who need to file Form 500, the individual income tax form. - This form is for residents whose income is not over $99,999 and who do not itemize deductions. - It applies to those who are not blind or 65 years or older and are filing as a single individual or married filing jointly. - Additionally, it is for individuals who do not claim any exemptions other than themselves and their spouse and who have no adjustments to their federal adjusted gross income. - The form is specifically for individuals who only derived income from wages, salaries, tips, dividends, and interest. - If eligible, they can file their state tax due using Form 500 EZ, which can be found on the Georgia Department of Revenue's website. - To fill out the form correctly, follow these steps: 1. In the top right-hand corner, enter your social security number and that of your spouse if filing jointly. 2. Enter your first name, middle initial, last name, and suffix (if applicable) and repeat the same for your spouse if applicable. 3. Provide your full address. 4. Enter your federal adjusted gross income on line 1. 5. If filing as a single individual, enter $5,000 on line 2. If filing jointly, enter $8,400 on line 2. 6. Subtract line 2 from line 1 and enter the difference on line 3. If this results in a negative number, proceed to step 7. 7. Consult the tax table in the separate instruction booklet to determine your tax amount and enter it on line 4. 8. If you are not claimed as a dependent on another form and are eligible for a low income tax credit, enter it on line 5. 9. Follow the instructions on lines 6 through 9 to determine the balance...

Award-winning PDF software

Pd7a e blank Form: What You Should Know

Mobile site. The tax amount (in dollars) can be deducted by calling toll-free at. For the best online banking experience, download our Free Canadian Tax Calculator, an interactive online tax calculator that allows users to estimate their tax, and then file online using the Canadian Revenue Agency's e-file system.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Pd7a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Pd7a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Pd7a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Pd7a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Pd7a E Blank Form